President John Dramani Mahama has abolished E-Levy, Betting Tax, Emissions Tax, and others byassenting to several amendment bills, in fulfillment of a campaign promise to revamp Ghana’s tax system to alleviate the financial burden on the citizenry.

This initiative signifies a monumental shift in the country’s economic approach to revenue generation to support the 2025 budget statement and economic policy of his government.

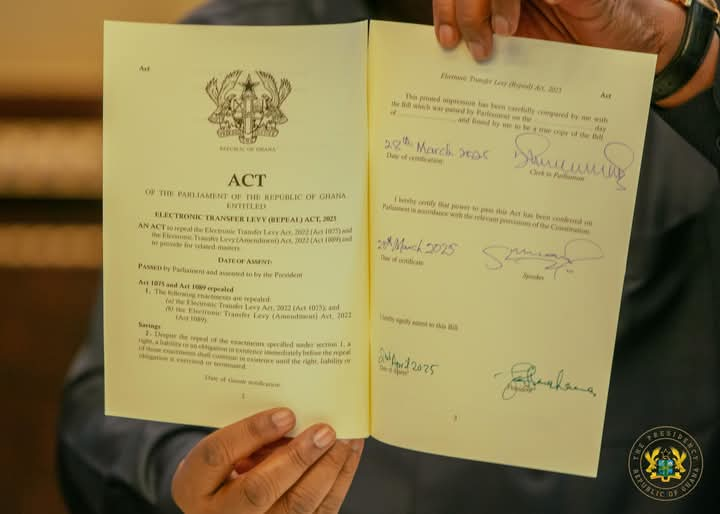

On April 2, 2025, President Mahama signed into law several pivotal pieces of legislation, including the repeal of the Electronic Transfer Levy, Betting Tax, and Emissions Tax, among others. This crucial decision is in line with the National Democratic Congress (NDC) Manifesto commitment to abolish excessive taxes, enhance economic relief, and stimulate growth in the country.

President Mahama endorsed the following bills as contained in the current budget and passed by parliament.

1. Electronic Transfer Levy (Repeal) Bill, 2025

2. Income Tax (Amendment) Bill, 2025

3. Emissions Levy (Repeal) Bill, 2025

4. Earmarked Funds Capping and Realignment (Amendment) Bill, 2025

5. Petroleum Revenue Management (Amendment) Bill, 2025

6. Public Financial Management Bill, 2025

7. Value Added Tax (Amendment) Bill, 2025

8. Gold Board Bill, 2025

These reforms are aimed at reducing financial pressures on both businesses and individuals, encouraging investments, and consumption.

During the signing event, President Mahama emphasized his dedication to establishing a fairer, more business-friendly tax environment, a core element of his social contract with Ghanaians during his first 120 days in office.

He characterized the repeal of burdensome taxes as a significant stride toward economic relief for all Ghanaians, intending to empower businesses, boost consumer confidence, and strengthen the economy.

The elimination of the E-Levy, which taxed mobile money and electronic transactions, is anticipated to revitalise digital financial services, benefiting small enterprises and individuals relying on mobile payments.

The withdrawal of the Betting Tax responds to the concerns of the youth and the gaming sector, while the exclusion of VAT on insurance services aims to render insurance more affordable and accessible.

Moreover, amendments to the Public Financial Management and Public Procurement Acts are set to enhance transparency, combat corruption, and drive efficiency in governmental expenditures. The Petroleum Revenue Amendment Bill focuses on the improved management of oil revenues to bolster national development.

Economic analysts have embraced these reforms, forecasting heightened business confidence, increased consumer spending, and enhanced investment inflow. Nonetheless, some experts advise that the government must implement strategic measures to compensate for potential revenue losses without placing new financial burdens on citizens.

Small business owners and mobile money operators, in particular, have voiced their strong support for the repeal of the E-Levy, deeming it essential for relieving the pressures associated with digital transactions.

With these tax reforms now enacted, the Mahama administration is set to unveil additional economic strategies focused on job creation, industrial expansion, and financial stability.

The government has assured Ghanaians of its commitment to responsible revenue management while creating an enabling environment conducive to economic growth.

As Ghana progresses with this new fiscal strategy, the upcoming months will be critical for evaluating the broader economic implications of these reforms for businesses, individuals, and national development.