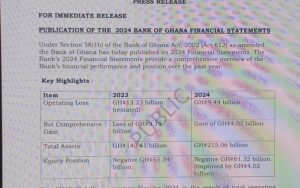

In 2024, Ghana’s Central Bank faced a challenging financial year, ultimately recording an operating loss of GH¢9.49 billion. While this figure might seem alarming at first glance, it tells a story of complex economic dynamics, strategic decisions, and the resilience of the financial system.

The bank’s total operating income for the year was GH¢9.40 billion, significantly less than its operating expenses, which soared to GH¢18.89 billion. The gap between income and expenses highlights the tough environment the bank navigated through.

Several key factors contributed to this financial outcome:

Cost of Open Market Operations: The bank spent GH¢8.60 billion on open market activities aimed at stabilizing the economy. These operations, though costly, are vital tools for managing liquidity and controlling inflation.

Revaluation and Exchange Losses: The bank faced GH¢3.49 billion in losses stemming from revaluations and currency exchange differences. Notably, it recorded a GH¢1.82 billion loss related to the Government’s Gold-for-Oil Programme, reflecting the volatile nature of international trade and currency fluctuations.

Currency Issue Expenses: The costs associated with currency issuance increased to GH¢1.01 billion from GH¢0.69 billion in 2023, indicating efforts to ensure sufficient currency circulation amidst economic pressures.

Additionally, the bank modified its accounting approach concerning foreign exchange gains and losses, especially related to revaluations of assets and liabilities in gold, special drawing rights, and foreign securities. This change affected how financial results were reported but aimed to provide a clearer picture of the bank’s financial health.

Despite the losses, there were signs of resilience. The bank’s equity improved by GH¢4.02 billion, ending the year at a negative value of GH¢61.32 billion. This improvement underscores ongoing efforts to strengthen the bank’s financial position.

PRESS RELEASE – PUBLICATION OF THE 2024 BANK OF GHANA FINANCIAL STATEMENTS JUNE25-1 (1)

The release of the 2024 financial statements exemplifies the bank’s commitment to transparency, accountability, and sound governance. These reports are publicly accessible on the bank’s website, reaffirming its dedication to openness.

Looking ahead, the bank remains steadfast in its mission to maintain price stability, ensure financial stability, and create an environment where businesses and individuals can flourish. While 2024 was a year of financial turbulence, it also laid the groundwork for strategic adjustments aimed at fostering a more resilient economy in the years to come.